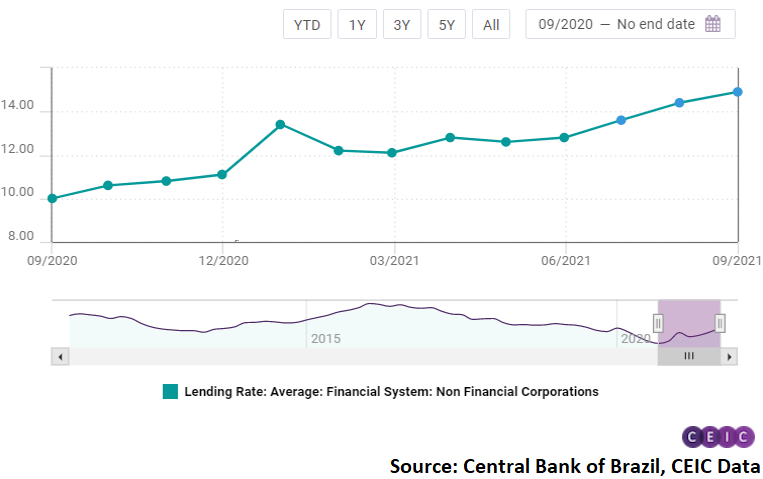

Brazil's non-financial corporations lending rate stood at 14.9% pa in September

Brazil's non-financial corporations lending rate reached 14.9% pa in September – a two-year record – reflecting the monetary tightening by the local central bank. On September 22, the central bank increased the benchmark interest rate Selic by 1pp to 6.25%. Notably, the average overdraft interest rate rose by 7.1pp to 333.7% pa in September, while the average interest rates for working capital loans and vehicle financing increased by 1.4pp and 1.1pp, respectively, to 17.6% and 15% pa.

The average interest rate for households rose by 0.5pp m/m to 25.8% pa in September, reflecting an increase in the average interest rate for revolving credit cards, by 3.7% m/m to 339.5% pa. The overall average interest rate stood at 21.6% pa – the highest rate since March 2020.

In spite of the rising interest rates, the number of new loans for non-financial companies expanded by 9.8% m/m to BRL 214.3bn in September. The total amount of loans expanded by a lesser extent, by 2.9% m/m to BRL 445.1bn, reflecting a decline of 2.7% m/m in household's new loans to BRL 230.8bn. Read more here.

Brazil's non-financial corporation's lending rate is updated monthly, available from March 2011 to September 2021. The data reached an all-time high of 22.6 % pa in February 2016 and a record low of 10 % pa in September 2020.

Further data and analysis on Brazil’s economy are available on the CEIC Brazil Economy in a Snapshot – Q3 2021 report.