India's COVID-19 Financial Markets, Economy and Activity Snapshot

India officially reported its first confirmed COVID-19 case on January 31. After that, some of the affected states in the country started to implement social distance measures and to monitor foreign travellers.

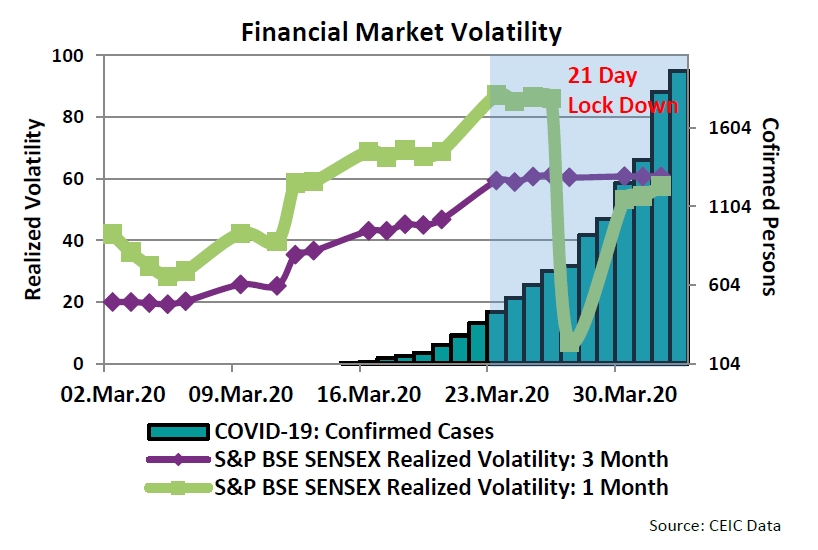

As the disease outbreak spread throughout the whole country, on March 22 the Indian government imposed a country-wide 21-day lockdown, sealing state borders and reducing interstate travels in order to contain the spread of the virus. As in other affected countries, the lockdown is likely to be prolonged.

The COVID-19 outbreak had a strong negative impact on India's capital market. On March 24, the day when PM Narendra Modi announced the 21-day lockdown, India's main equity index S&P BSE SENSEX plummeted to 25,981, its lowest level since 2016.

The stock market plunged by more than 37% since the beginning of the year – a decline that was triggered by the massive capital flight out of the country.

In an attempt to combat the devastating impact on the economy, the Reserve Bank of India cut its benchmark interest rate and boosted liquidity.

Despite the above-target headline inflation, on March 27, the third day of the nationwide lockdown, the central bank slashed the benchmark repurchase rate by 75 basis points, from 5.15% pa to 4.4% pa.

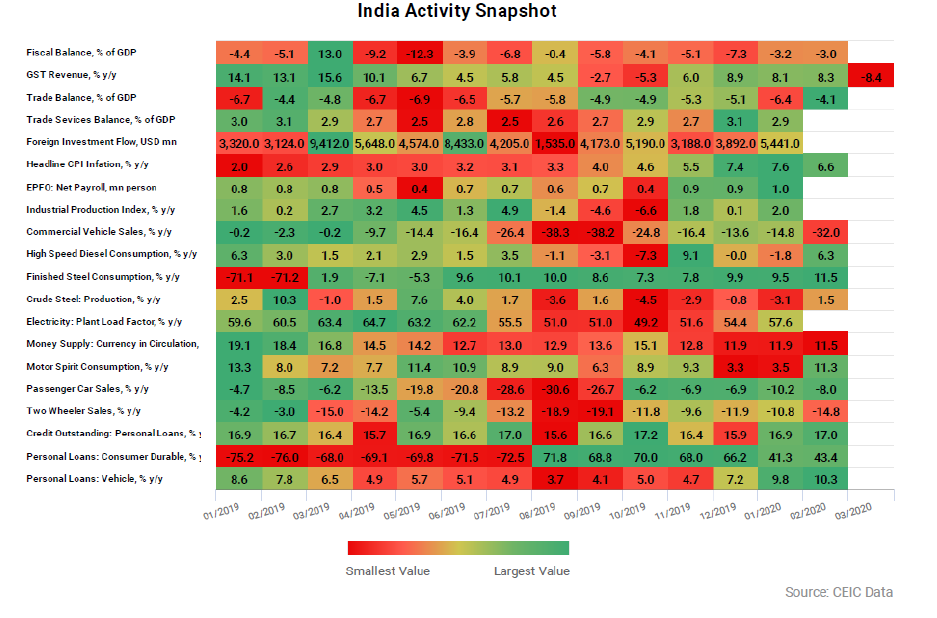

The nationwide lockdown and the financial market decline have a significant impact on domestic demand and the whole real economy, which is already evident from some of the economic activity data for February and March.

The commercial vehicle sales plummeted by 32% y/y in February, while the GST revenue dropped by 8.4% y/y in March, suggesting a serious consumer spending decrease.

The CEIC India Premium Database is the definitive go-to resource for analysts, investors, and strategists to assess and run analytical models on the Indian economy. Learn more here