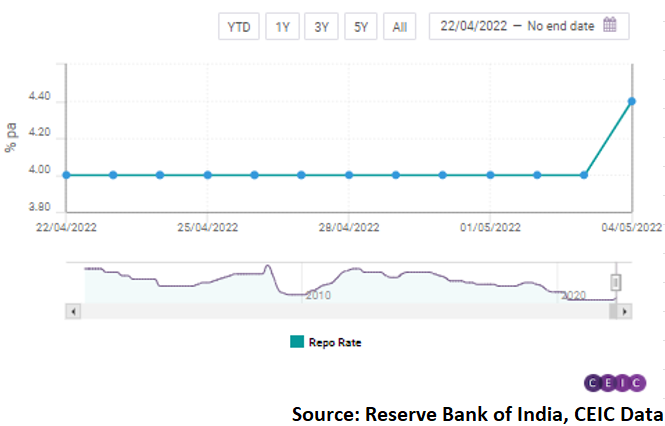

India’s Monetary Policy Committee hikes policy rate to 4.4% p.a

The Monetary Policy Committee (MPC), under the Reserve Bank of India, increased the policy rate or the repo rate by 40 basis points to 4.4% p.a, in an out-of-cycle announcement. The rate hike was carried out after two years of keeping the rate unchanged at 4.0% p.a.

The global economy has been under tremendous turbulence with supply disruptions and price escalations that have created inflationary pressure. In the case of India, a waning COVID-19 third wave and easing of restrictions have provided an economic momentum, but at the same time, headline inflation surged to 7.0% in March, a 100 basis points above RBI’s upper inflation target band of 6%.

The hardening of inflation was evident from the sharp upward revision of core inflation to 6.5% in March, worsened by the geopolitical shocks. The MPC’s outlook toward inflation remains grim as global commodity price dynamics are driving inflation through both direct and indirect channels. In addition, the resurgence of COVID-19 could sustain higher logistics costs.

The outlook for growth, on the other hand, remains positive, driven by a forecast of normal monsoons, a steady vaccination drive, and an uptick in contact-intensive services. Hence, the decision to increase the rate was unanimous.

Read more

Further data and analysis on India’s economy are available on the CEIC India Economy in a Snapshot – Q2 2022 report.