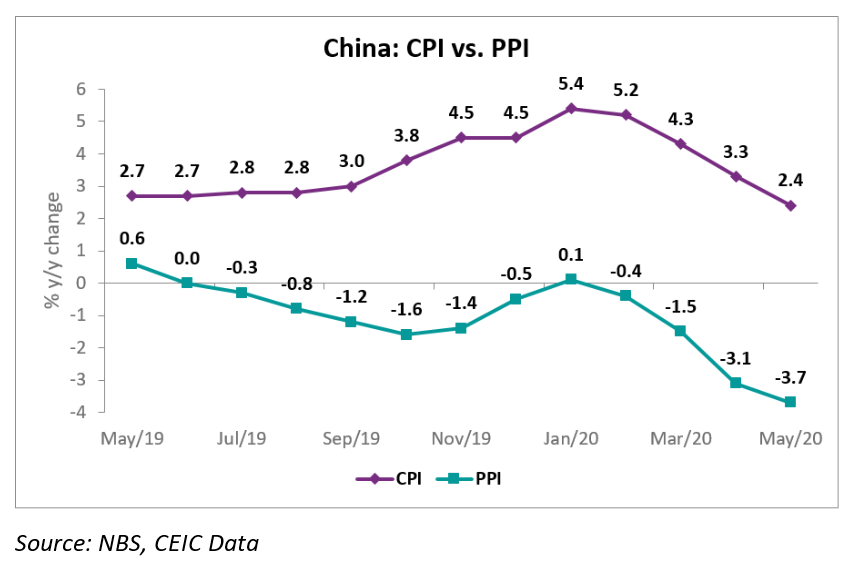

Deflationary Pressure in China is Materialising in May

In May 2020, China’s Consumer price index (CPI) grew by 2.4% y/y, compared to 3.3% y/y in the previous month, while the Producer price index (PPI) dropped further by 3.7% y/y compared to a 3.1% y/y decline in April. Both the CPI and PPI figures are lower than expected, suggesting the deflationary pressure continues to accumulate.

The CPI increase was mainly a result of the carryover effect from the high pork prices in 2019. The carryover effect accounted for 3.2% y/y of the May figure and new price factor - for the remaining -0.8% y/y. In other words, it is the new price factor that shows the disinflationary pressure is materialising in the CPI. Core inflation, which excludes food and energy prices, stayed at 1.1% y/y, unchanged compared to April.

The decreasing PPI was a result of the weaker domestic and external demand in May 2020. The producer goods PPI dropped further by 5.1% y/y, compared to a 4.5% y/y drop in April. The consumer goods PPI continued to decelerate: it fell by 0.4 pp to 0.5% y/y in May.

Detailed data and analysis on COVID-19 and its economic impact can be found in CEIC Coronavirus Data Monitor. Sign in for further data and information on China’s Economy in the CEIC China Economy in a Snapshot - Q2 2020.