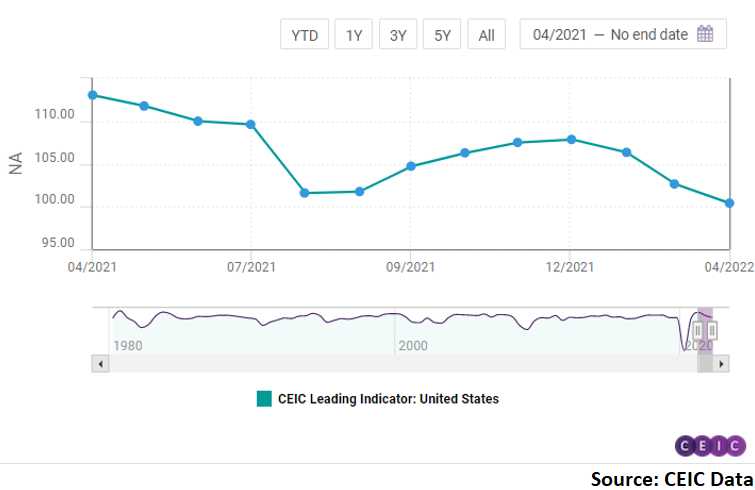

CEIC Leading Indicator for the US lowest in 15 months

The CEIC Leading Indicator for the US decelerated for the third consecutive month in April 2022, decreasing by 2.2 points m/m to 100.4, according to the flash estimate. This is the lowest reading of the non-smoothed indicator since January 2021. The smoothed CEIC Leading Indicator also decelerated in April, falling to 102.3, signaling that the US economy has started Q2 2022 at a slow pace, after contracting in Q1.

The Conference Board consumer confidence index decreased marginally in April 2022, dropping to 107.3 from 107.6 in the previous month. Despite constantly rising inflation, high commodity prices and geopolitical risks related to the war in Ukraine, consumer confidence remains robust on the back of strong consumption and a tight labour market. US jobless claims increased slightly in April, but remain close to historic lows, while non-farm payrolls kept increasing and the unemployment rate remained low, at 3.6%. The housing market index declined for the fourth consecutive month, dropping to 77.

The ISM manufacturing PMI fell to 55.4 in April from 57.1 in the previous month. This marked the 23rd consecutive month of manufacturing sector growth since the contraction between March and May 2020, but also the lowest reading since September 2020. The deceleration of the index can be attributed to labour shortage problems in all tiers of the supply chain. Motor vehicle sales in the United States increased for the first time since January 2022, rising by 880,000 to 14.8mn at a seasonally adjusted annual rate in April.

On an annual basis, however, vehicle sales dropped by 21.4%, the ninth consecutive month of double-digit decline. The S&P 500 stock market index closed April at 4,131.9, compared to 4,530.4 in the end of March. Notably, the consumer discretionary subindex fell by 13% m/m to 1,272, while the IT and telecom ones dropped by 11.3% and 15,8% m/m, respectively, to 2,478 and 198.

More about the CEIC Leading Indicator for the US here

Further data and analysis on the US economy are available on the CEIC US Economy in a Snapshot – Q2 2022 report.