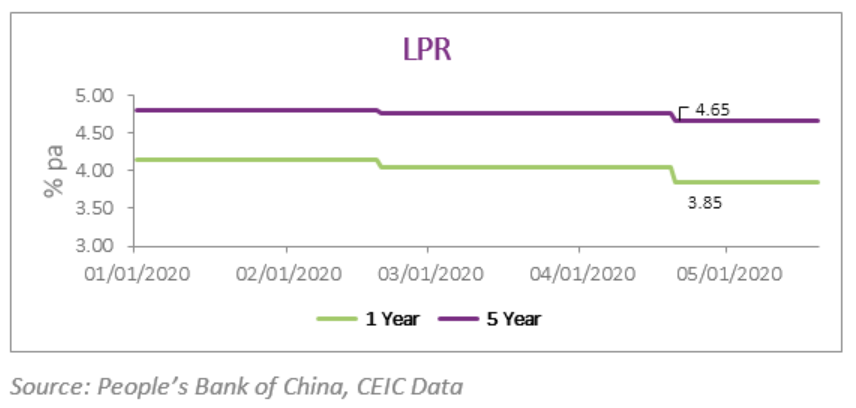

中国: 1年および5年ローンプライムレートを引き下げ

The People’s Bank of China (PBoC) cut the one-year and five-year loan prime rates (LPR) on April 20, 2020. The one-year LPR was cut by 20bp to 3.85% from 4.05% in March, in line with the market expectations, while the five-year LPR, a reference for mortgages, was cut by 10bp to 4.65%. China introduced the LPR reform in August 2019 as part of the broader government effort to liberalise interest rates in the country.

These asymmetric cuts suggest that the central government would stick to the policy announced in July 2019, namely – not using investments in real estate and not stimulating households to buy residential property as a short-term remedy to support economic growth. However, given the fact that China’s quarterly real GDP plunged by 6.8% y/y in Q1 2020, the market expects more cuts on the 5-year LPR as a counter-cyclical measure.

Sign in for detailed data and analysis on China’s Economy in the CEIC China Economy in a Snapshot – Q2 2020.